You can use your GI Bill for your real-estate license if you are a veteran of the military. Your GI Bill can pay for certification tests and the course. The Department of Veterans Affairs provides more information about this. You might be eligible for reimbursement by contacting Department of Veterans Affairs.

There are several other options for military veterans who are not currently serving. First, you can get scholarships to help pay for some of your costs. Dependent on the program, you may qualify for a scholarship up to $1,000. These scholarships can only be used for classes-based courses.

A second option is to obtain your license through an online pre-license class. AceableAgent offers several courses for those interested in obtaining their real estate license. These courses come at a reasonable price and offer all the training required. However, additional costs for obtaining your license as a real estate agent will be charged to you.

Many national brokerages are now offering programs to help recruit veterans. One example is the Northern Virginia Association of Realtors, which offers a program for transitioning military personnel to get started in the real estate industry. Interested veterans need to submit a certificate proving eligibility and a DD214.

If you are not already a licensed real estate agent, you can take a pre-license course at Florida Real Estate University. The university offers an intensive 63-hour course in pre-licensing for sales associates. While fees are required, they will be reimbursed by VA. This will make your career in real estate possible within a matter of days.

Another program that can help you is Operation RE/MAX. This program matches veterans and their spouses to mentors who will help them navigate the path of becoming licensed real-estate professionals. They will then commit to 24-months to the BHGRE metro Brokers' Xcelerater program. After passing their real estate exam, they are eligible to begin work.

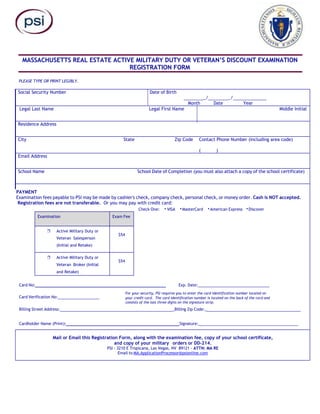

Active-duty personnel may request a waiver of the initial license fee. This can be done online and by mailing an application to assessor. You should note that a waiver will not be granted for renewals of your license and criminal background checks.

Members of the military can take advantage of many benefits offered by Texas Real Estate Commission. This includes an expedited applicant process. A military service member who holds a valid license in another State can be eligible for the program.

Veterans to REP is open to both active military personnel and reserve soldiers. For military spouses, there are additional benefits. Both programs provide post-licensing support and training.

Another option is to contact the Department of Veterans Affairs to determine if your certification and license costs can be reimbursed. The VA website lists approved opportunities for real estate license reimbursement.

FAQ

How much money will I get for my home?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. According to Zillow.com, the average home selling price in the US is $203,000 This

What is a "reverse mortgage"?

A reverse mortgage lets you borrow money directly from your home. It works by allowing you to draw down funds from your home equity while still living there. There are two types available: FHA (government-insured) and conventional. Conventional reverse mortgages require you to repay the loan amount plus an origination charge. FHA insurance will cover the repayment.

What are the benefits to a fixed-rate mortgage

With a fixed-rate mortgage, you lock in the interest rate for the life of the loan. This means that you won't have to worry about rising rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to Manage A Rental Property

It can be a great way for you to make extra income, but there are many things to consider before you rent your house. These tips will help you manage your rental property and show you the things to consider before renting your home.

Here are some things you should know if you're thinking of renting your house.

-

What is the first thing I should do? You need to assess your finances before renting out your home. You may not be financially able to rent out your house to someone else if you have credit card debts or mortgage payments. It is also important to review your budget. If you don't have enough money for your monthly expenses (rental, utilities, and insurance), it may be worth looking into your options. It may not be worth it.

-

How much is it to rent my home? There are many factors that go into the calculation of how much you can charge to let your home. These include things like location, size, features, condition, and even the season. You should remember that prices are subject to change depending on where they live. Therefore, you won't get the same rate for every place. Rightmove has found that the average rent price for a London one-bedroom apartment is PS1,400 per mo. This means that your home would be worth around PS2,800 per annum if it was rented out completely. Although this is quite a high income, you can probably make a lot more if you rent out a smaller portion of your home.

-

Is it worthwhile? Doing something new always comes with risks, but if it brings in extra income, why wouldn't you try it? Be sure to fully understand what you are signing before you sign anything. You will need to pay maintenance costs, make repairs, and maintain the home. Renting your house is not just about spending more time with your family. Before you sign up, make sure to thoroughly consider all of these points.

-

Is there any benefit? There are benefits to renting your home. You have many options to rent your house: you can pay off debt, invest in vacations, save for rainy days, or simply relax from the hustle and bustle of your daily life. No matter what your choice, renting is likely to be more rewarding than working every single day. If you plan well, renting could become a full-time occupation.

-

How can I find tenants Once you decide that you want to rent out your property, it is important to properly market it. You can start by listing your property online on websites such as Rightmove and Zoopla. After potential tenants have contacted you, arrange an interview. This will enable you to evaluate their suitability and verify that they are financially stable enough for you to rent your home.

-

What are the best ways to ensure that I am protected? If you fear that your home will be left empty, you need to ensure your home is protected against theft, damage, or fire. Your landlord will require you to insure your house. You can also do this directly with an insurance company. Your landlord will often require you to add them to your policy as an additional insured. This means that they'll pay for damages to your property while you're not there. This doesn't apply to if you live abroad or if the landlord isn’t registered with UK insurances. In such cases you will need a registration with an international insurance.

-

Sometimes it can feel as though you don’t have the money to spend all day looking at tenants, especially if there are no other jobs. But it's crucial that you put your best foot forward when advertising your property. Make sure you have a professional looking website. Also, make sure to post your ads online. Additionally, you'll need to fill out an application and provide references. Some people prefer to do everything themselves while others hire agents who will take care of all the details. Interviews will require you to be prepared for any questions.

-

What should I do after I have found my tenant? If you have a lease in place, you'll need to inform your tenant of changes, such as moving dates. You can negotiate details such as the deposit and length of stay. You should remember that although you may be paid after the tenancy ends, you still need money for utilities.

-

How do I collect my rent? You will need to verify that your tenant has actually paid the rent when it comes time to collect it. You'll need remind them about their obligations if they have not. After sending them a final statement, you can deduct any outstanding rent payments. If you're struggling to get hold of your tenant, you can always call the police. They will not normally expel someone unless there has been a breach of contract. However, they can issue warrants if necessary.

-

How can I avoid problems? It can be very lucrative to rent out your home, but it is important to protect yourself. Ensure you install smoke alarms and carbon monoxide detectors and consider installing security cameras. Check with your neighbors to make sure that you are allowed to leave your property open at night. Also ensure that you have sufficient insurance. Finally, you should never let strangers into your house, even if they say they're moving in next door.