Obtaining a real estate license in South Carolina is an important first step for any real estate professional. Real estate agents and property managers can be licensed by the South Carolina Real Estate Commission. To apply to for a realty license, you must be at the least 18 years old. You will also need to pass the state exam to test your knowledge and practice in real estate law. A background check may be required. You will be required to disclose any criminal convictions.

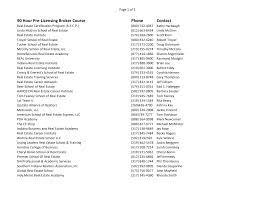

You will need at least 60 hours to be able to pursue a career as a real estate agent. You can take a prelicensing course at one of the many South Carolina-based real estate schools. These schools offer both online and in-person proctored exams. They can help you to schedule the test and help you through the application process. They may also offer a variety study tools such as mock exams and study groups.

A course online is an option for those who want to be able to get their South Carolina real property license quickly and easily. Some real estate schools even offer weekend cram courses.

Before you can get your real license, you will need to pass the state exam and complete the Unit II advanced real-estate principles course. This advanced course prepares you to work in the industry. The advanced course may not be required if the exam was taken in another jurisdiction.

For the realty licensing exam, you must submit a criminal record report. This report should be included with your application. You'll also need to pass a background check, which is based on fingerprints. SCREC will verify your legal authorization to practice in South Carolina by reviewing your history. If you have a criminal record, you may be unable to receive a real estate license in South Carolina.

Passing the real estate licensing exam requires a minimum score of 70%. There are two parts to the exam: the national and the state. The state section tests your knowledge in South Carolina's real estate laws and practices. While the national portion will test your knowledge in real estate law. Each part has 110 questions.

After passing the state exam, you must pass a final exam. There are two different types of exams to choose from: a proctored exam, which will be administered by a South Carolina real estate school, or an unproctored exam, which will be given online. This is the most convenient option for those who live a busy life. The exam can be completed in three hours. You will need to answer at the least 40 national and at least 80 state questions.

It can be rewarding to get a South Carolina license in real estate. There are many career opportunities for you.

FAQ

How do I repair my roof

Roofs can leak due to age, wear, improper maintenance, or weather issues. Minor repairs and replacements can be done by roofing contractors. Contact us for further information.

Do I require flood insurance?

Flood Insurance protects from flood-related damage. Flood insurance protects your possessions and your mortgage payments. Find out more information on flood insurance.

What should you look out for when investing in real-estate?

The first step is to make sure you have enough money to buy real estate. If you don’t save enough money, you will have to borrow money at a bank. It is important to avoid getting into debt as you may not be able pay the loan back if you default.

It is also important to know how much money you can afford each month for an investment property. This amount must cover all expenses related to owning the property, including mortgage payments, taxes, insurance, and maintenance costs.

Finally, ensure the safety of your area before you buy an investment property. It would be best if you lived elsewhere while looking at properties.

How much money do I need to purchase my home?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. Zillow.com reports that the average selling price of a US home is $203,000. This

What are the pros and cons of a fixed-rate loan?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loan payments have lower interest rates because they are fixed for a certain term.

What are the drawbacks of a fixed rate mortgage?

Fixed-rate mortgages tend to have higher initial costs than adjustable rate mortgages. A steep loss could also occur if you sell your home before the term ends due to the difference in the sale price and outstanding balance.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to purchase a mobile home

Mobile homes can be described as houses on wheels that are towed behind one or several vehicles. Mobile homes have been around since World War II when soldiers who lost their homes in wartime used them. People who want to live outside of the city are now using mobile homes. Mobile homes come in many styles and sizes. Some are small, while others are large enough to hold several families. Some are made for pets only!

There are two main types of mobile homes. The first type is produced in factories and assembled by workers piece by piece. This happens before the product can be delivered to the customer. You could also make your own mobile home. Decide the size and features you require. Next, ensure you have all necessary materials to build the house. Finally, you'll need to get permits to build your new home.

If you plan to purchase a mobile home, there are three things you should keep in mind. You might want to consider a larger floor area if you don't have access to a garage. If you are looking to move into your home quickly, you may want to choose a model that has a greater living area. The trailer's condition is another important consideration. You could have problems down the road if you damage any parts of the frame.

You should determine how much money you are willing to spend before you buy a mobile home. It is important to compare prices across different models and manufacturers. Also, look at the condition of the trailers themselves. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

Instead of purchasing a mobile home, you can rent one. Renting allows the freedom to test drive one model before you commit. Renting isn’t cheap. The average renter pays around $300 per monthly.