In order to sell commercial real estate in Oregon, you'll need a real estate broker's license. After completing a series, you can obtain a license as a broker by passing the Oregon real-estate exam. The licensing process takes approximately six to eight months. You can speed up the process if you start early. The average time it takes to complete the course for a full-time student is approximately two months.

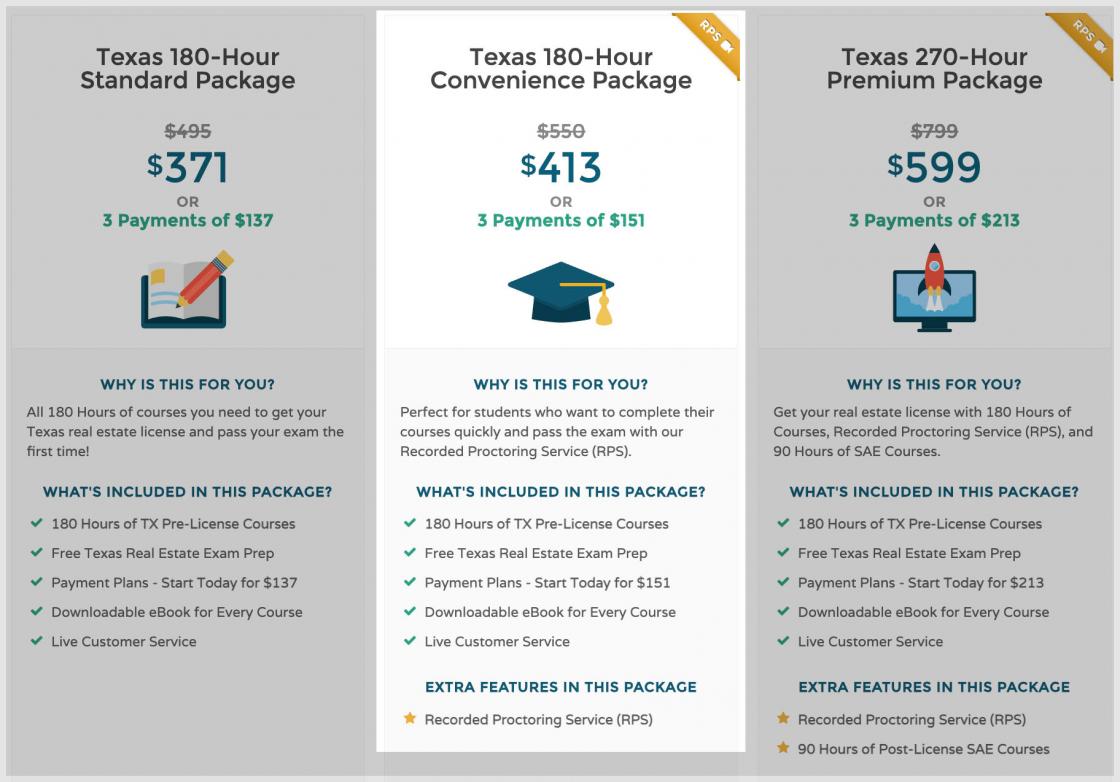

To start the process, you'll need to complete a minimum of 150 hours of classroom or online study. Online courses are provided by an accredited education provider and are available in different formats. They are easy to use and can be accessed at your own pace. You also have the option to enroll in an actual, in-person course. If you decide to opt for the latter option, you will need to go to a local licensed school.

After completing all required coursework, you will need to submit your application along with a fee. In addition, you'll need to take a background check. This process can take up to 4 weeks and may require fingerprinting. Once you have passed your background check, an Applicant ID will be issued to you. You can then create an eLicense account to begin earning your license.

Your eLicense will contain information about all of your courses, as well the status of their completion. A final exam is also required. A comprehensive final can take as little as 20 questions, while a more advanced course can have as many as 150.

The exam itself is designed to test your knowledge of key topics in property law and valuation. It's divided into two sections: the State section, which lasts 75 minutes, and the National section, which lasts about two hours. As a rule of thumb, the passing score for the State section is about 60 percent while that of the National section is about 80 percent.

There are 130 questions required for the real estate broker exam. Candidates can either sit in person at testing centers or online for the exam. Either way, the first part focuses on national laws, while the second part covers state laws.

You should do your research before deciding whether to enroll in an online or face-to-face course. You can find information about license requirements and background checks on the state's official site. You can also contact the state's Real Estate Agency if you have questions.

Studying is key to a successful Oregon real estate exam. It is not easy to pass the test the first time. Be prepared. A pre-licensing course can help you increase your chances of passing.

You must be at minimum 18 years of age, have a high-school diploma or GED and pass a background screening to receive your license. The State of Oregon website provides information on the exam and how to apply.

FAQ

How long does it usually take to get your mortgage approved?

It all depends on your credit score, income level, and type of loan. It takes approximately 30 days to get a mortgage approved.

Can I buy a house in my own money?

Yes! There are programs available that allow people who don't have large amounts of cash to purchase a home. These programs include government-backed loans (FHA), VA loans, USDA loans, and conventional mortgages. More information is available on our website.

What are the three most important things to consider when purchasing a house

The three main factors in any home purchase are location, price, size. It refers specifically to where you wish to live. Price refers the amount that you are willing and able to pay for the property. Size refers to the space that you need.

How can I eliminate termites & other insects?

Termites and other pests will eat away at your home over time. They can cause damage to wooden structures such as furniture and decks. It is important to have your home inspected by a professional pest control firm to prevent this.

How many times do I have to refinance my loan?

It all depends on whether your mortgage broker or another lender is involved in the refinance. You can refinance in either of these cases once every five-year.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to Locate Houses for Rent

Moving to a new area is not easy. However, finding the right house may take some time. Many factors affect your decision-making process when choosing a home. These include location, size, number of rooms, amenities, price range, etc.

We recommend you begin looking for properties as soon as possible to ensure you get the best deal. You should also consider asking friends, family members, landlords, real estate agents, and property managers for recommendations. This will give you a lot of options.