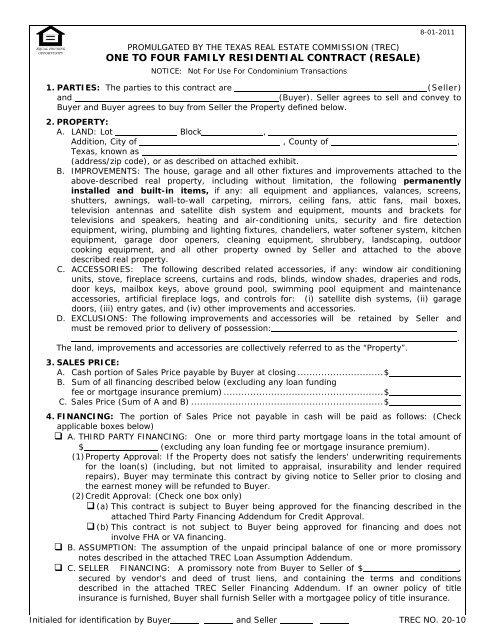

You will likely be required to pay a commission to a realtor, regardless of whether you are buying or selling a house. The amount you'll have to pay is negotiable, so you should consider it before you decide to buy or sell a property. A real estate agent is a valuable resource, and he or she can help you negotiate for a better price.

There are two kinds of commissions that can be paid by the buyer or the seller. These commissions can be paid as a flat fee or as a percentage of the sales price. When interviewing agents, you can inquire about the commission of your realtor. Good agents will accept a lower fee so that you can get the best price for what you own.

The commission paid by the seller is typically between five and six percent of the final sale price of the property. This figure may vary depending on the state, but is usually fairly standard. In some states, such as California, the commission is negotiable.

The commission is usually split between the seller's and buyer's agents. The listing agreement will outline the exact split. In some instances, the commission is charged at a prepaid rate, which will be cheaper. If you're concerned about who pays the realtor, do some research in your state to find out the details of the rules.

Traditionally, a realty agent's commission is charged at signing the sale document. But, there are some agents who charge fees when you sign a deposit contract. These fees may include a percentage fee and a commission that you don't have to pay until closing.

Federal law does not regulate agents' fees. It is not required but it is commonly included in the list price for a home. Be aware that many online realtors charge as much as 50% to sign a deed. Not all agents will accept these deals.

Other than the commission paid by seller, agents will need to cover expenses related to the home-selling process. These expenses include listing, signage, major staging, and other costs. These expenses can also include printing materials, photography, or other costs. Before you begin negotiating for a home, it is important to ensure that you are getting a fair deal.

A rebate on buyer commissions may be possible. This is a type of commission that you give to the buyer's representative as a reward in bringing qualified buyers to your property. This can be a good way to draw in more buyers. It can also backfire. If you have a good buyer's agent, he or she can use the commission to your advantage.

It is not unusual to need to put up a lot of cash to buy a house. It is important to find a knowledgeable real estate agent. A savvy agent can help you find the right area and negotiate the best price for your house.

FAQ

What is a reverse loan?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. You can draw money from your home equity, while you live in the property. There are two types to choose from: government-insured or conventional. If you take out a conventional reverse mortgage, the principal amount borrowed must be repaid along with an origination cost. If you choose FHA insurance, the repayment is covered by the federal government.

What are the chances of me getting a second mortgage.

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage can be used to consolidate debts or for home improvements.

How long does it take to get a mortgage approved?

It depends on several factors such as credit score, income level, type of loan, etc. It typically takes 30 days for a mortgage to be approved.

Is it possible to quickly sell a house?

If you have plans to move quickly, it might be possible for your house to be sold quickly. You should be aware of some things before you make this move. You must first find a buyer to negotiate a contract. Second, prepare your property for sale. Third, advertise your property. Finally, you should accept any offers made to your property.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to find an apartment?

When you move to a city, finding an apartment is the first thing that you should do. This involves planning and research. This includes researching the neighborhood, reviewing reviews, and making phone call. There are many ways to do this, but some are easier than others. Before you rent an apartment, consider these steps.

-

It is possible to gather data offline and online when researching neighborhoods. Online resources include Yelp and Zillow as well as Trulia and Realtor.com. Local newspapers, landlords or friends of neighbors are some other offline sources.

-

See reviews about the place you are interested in moving to. Yelp, TripAdvisor and Amazon provide detailed reviews of houses and apartments. You may also read local newspaper articles and check out your local library.

-

For more information, make phone calls and speak with people who have lived in the area. Ask them what they liked and didn't like about the place. Ask for recommendations of good places to stay.

-

Consider the rent prices in the areas you're interested in. Renting somewhere less expensive is a good option if you expect to spend most of your money eating out. You might also consider moving to a more luxurious location if entertainment is your main focus.

-

Find out information about the apartment block you would like to move into. What size is it? How much is it worth? Is it pet-friendly? What amenities does it have? Are you able to park in the vicinity? Are there any special rules that apply to tenants?