You might be interested in diversifying your portfolio by investing in real estate. There are many reasons why real estate investing is a good investment. In addition to the potential for high returns, it also has many pitfalls to avoid. Real estate can be risky. You also need to maintain your property and have insurance. This article will discuss the steps you need to take to avoid most common pitfalls. For beginners wanting to diversify their portfolio, this article provides valuable guidance.

Real estate investing is a great way to diversify your investment portfolio

Real estate investing can be a great way of diversifying your portfolio and avoiding high-risk investments. Real estate is also an excellent way to diversify your portfolio and enjoy cash-flow from rental properties, appreciation of your property, and substantial capital gains during your retirement years. Investing in real estate is not for everyone, but it is a smart choice for those who want to minimize risk while generating significant returns.

Real estate has low correlation to other types of assets such as bonds and stocks, and it typically rises and falls after the rest of the economy. Each real estate market is unique, so factors that sink the value of a home in one market may not affect it in another. CFP Daniel Kern, chief financial strategist at TFC Financial Management, Boston, says it's a smart move to dedicate at least 5-10 percent of your total portfolio to real estate.

It is a wise financial decision

Real estate is an appealing option when it comes to diversifying portfolios. It is not closely linked to the stock market so investors believe it is a smart move to reduce losses. You should remember that there is no sure thing and there may be significant losses. This article will discuss some of the main benefits of investing in real estate. This article will also provide an overview of the different types of real estate, as well as a few different strategies for investing in it.

Real estate can be a bankable asset and provide steady income. Because you can borrow against property value, you don't need a large amount of cash upfront. You can also use money borrowed from banks to finance your investment. Low interest rates will allow you to enjoy the benefits of free money. Real estate investments can provide tax benefits.

It takes a team.

It is crucial that you have the right professionals to assist with your real estate ventures. Perform thorough due diligence on every potential team member before hiring. Refer to references and ask for recommendations, if necessary. To get the best out of your real-estate team, you need to know your market, niche, and strategy. Success is dependent on a cohesive team.

Real estate investing requires a legal counsel. They will ensure that all paperwork is correct and that evictions are done in accordance with the law. To keep track of finances, and organize books, you will need a bookkeeper who has experience in real-estate investing. Marketing coordinators are also essential. Final word: A team is key to any real estate investing business.

It can be done in many ways

There are many options for real estate investing. Some people use their own capital to purchase property. Others form funds with others. Depending upon your goals, you may buy or rent houses. Or, you could use money from others to renovate properties. Your investment can bring you cash flow in either way. These are just a few ways you can get started in real estate investing. These strategies vary in difficulty and reward.

A great way to invest in real-estate is to purchase a house, fix it up and then sell it at a higher cost. This strategy is extremely lucrative, but it takes a lot of time and money. Real estate investment can be a profitable way to get in on the game, provided you have patience and the time. It is possible to invest in several properties simultaneously and make large profits.

FAQ

Can I purchase a house with no down payment?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include government-backed mortgages (FHA), VA loans and USDA loans. Visit our website for more information.

What is a Reverse Mortgage?

A reverse mortgage lets you borrow money directly from your home. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types available: FHA (government-insured) and conventional. A conventional reverse mortgage requires that you repay the entire amount borrowed, plus an origination fee. FHA insurance covers your repayments.

Is it possible to quickly sell a house?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. Before you sell your house, however, there are a few things that you should remember. First, you need to find a buyer and negotiate a contract. Second, prepare your property for sale. Third, advertise your property. Finally, you need to accept offers made to you.

Should I rent or purchase a condo?

Renting may be a better option if you only plan to stay in your condo a few months. Renting saves you money on maintenance fees and other monthly costs. On the other hand, buying a condo gives you ownership rights to the unit. You are free to make use of the space as you wish.

Is it better buy or rent?

Renting is typically cheaper than buying your home. It's important to remember that you will need to cover additional costs such as utilities, repairs, maintenance, and insurance. There are many benefits to buying a home. For example, you have more control over how your life is run.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

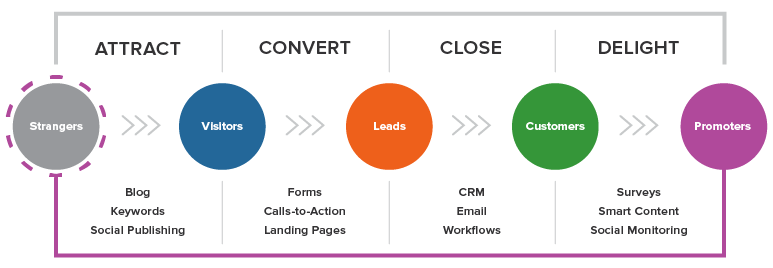

How to find real estate agents

A vital part of the real estate industry is played by real estate agents. They help people find homes, manage their properties and provide legal advice. Experience in the field, knowledge of the area, and communication skills will make a great real estate agent. Online reviews are a great way to find qualified professionals. You can also ask family and friends for recommendations. It may also make sense to hire a local realtor that specializes in your particular needs.

Realtors work with residential property sellers and buyers. A realtor's job it to help clients purchase or sell their homes. Apart from helping clients find the perfect house to call their own, realtors help manage inspections, negotiate contracts and coordinate closing costs. A majority of realtors charge a commission fee depending on the property's sale price. However, some realtors don't charge a fee unless the transaction closes.

There are many types of realtors offered by the National Association of REALTORS (r) (NAR). NAR members must pass a licensing exam and pay fees. Certified realtors are required to complete a course and pass an exam. Accredited realtors are professionals who meet certain standards set by NAR.